Understanding and Financing Car Insurance Minimums: A Complete Guide

Finding the right car insurance can feel overwhelming, especially when you're grappling with minimum coverage requirements and how to finance them. This guide breaks down the essentials, helping you navigate the process confidently.

What are Minimum Car Insurance Requirements?

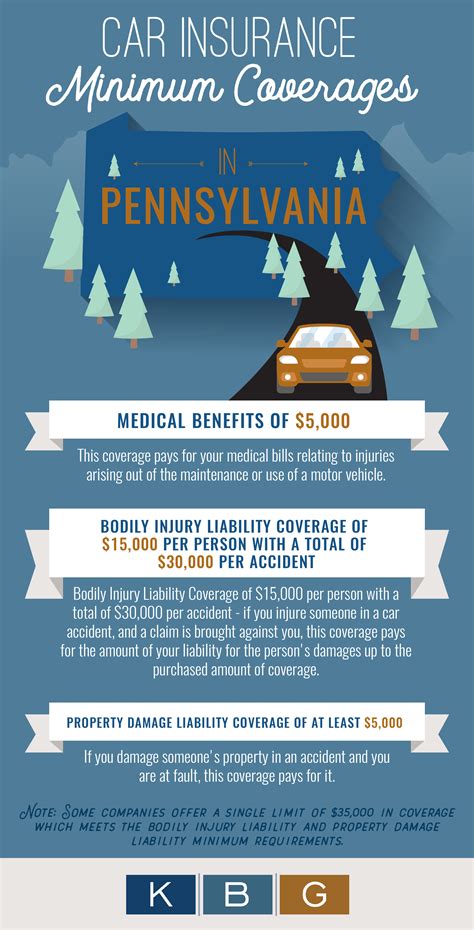

Every state in the US mandates minimum car insurance coverage, but these requirements vary significantly. Minimum coverage typically includes:

- Bodily Injury Liability: This covers injuries you cause to others in an accident. It's usually expressed as a split limit, such as 25/50/25, meaning $25,000 per person injured, $50,000 per accident, and $25,000 for property damage.

- Property Damage Liability: This covers the damage you cause to another person's vehicle or property in an accident.

Important Note: Minimum coverage often doesn't fully protect you financially. A serious accident could easily exceed these limits, leaving you personally responsible for substantial costs. Consider purchasing higher liability limits to protect your assets.

How Much Does Minimum Coverage Cost?

The cost of minimum car insurance varies based on numerous factors:

- Your driving record: Accidents and tickets significantly impact premiums.

- Your age and gender: Younger drivers generally pay more.

- Your location: Insurance rates differ geographically based on accident rates and claims costs.

- Your vehicle: The make, model, and year of your car influence the cost of insurance.

- Your credit score: In many states, credit history is a factor in determining insurance rates.

Financing Your Car Insurance: Options to Explore

If you're struggling to afford even minimum car insurance, several options can help:

- Payment Plans: Most insurance companies offer monthly payment plans, making coverage more manageable. Inquire about available options with your insurer.

- Bundling Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Comparison Shopping: Use online comparison tools to compare rates from different insurers. This allows you to find the most competitive pricing.

- Discounts: Explore potential discounts offered by your insurer, such as good driver discounts, safe-driver programs, or discounts for bundling policies.

- Government Assistance Programs: In some cases, government assistance programs may be available to help with insurance costs. Research state and local resources to see if you qualify.

Tips for Keeping Car Insurance Affordable

- Maintain a clean driving record: Avoiding accidents and traffic violations is the best way to keep your premiums low.

- Consider a higher deductible: A higher deductible means a lower premium but a larger out-of-pocket expense if you make a claim.

- Improve your credit score: A better credit score can lead to lower insurance rates in many states.

- Take a defensive driving course: Completing a defensive driving course may qualify you for discounts.

Beyond Minimums: Protecting Yourself Fully

While minimum coverage fulfills legal requirements, it might not offer sufficient protection in the event of a significant accident. Consider purchasing:

- Uninsured/Underinsured Motorist Coverage: This protects you if you're involved in an accident with an uninsured or underinsured driver.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-accident events, such as theft, vandalism, or hail.

Understanding your state's minimum car insurance requirements and exploring available financing options empowers you to make informed decisions about your auto insurance. By carefully considering your needs and budget, you can find affordable coverage that provides adequate protection. Remember, your safety and financial security should be your top priorities.